The Business Model Upgrade: Agentic AI for Personalized Finance

Financial services stand at an inflection point. Institutions that embrace the next leap in personalization won’t just deepen customer loyalty, they’ll unlock entirely new revenue streams, markedly lower costs, and strengthen their roles in clients’ lives.

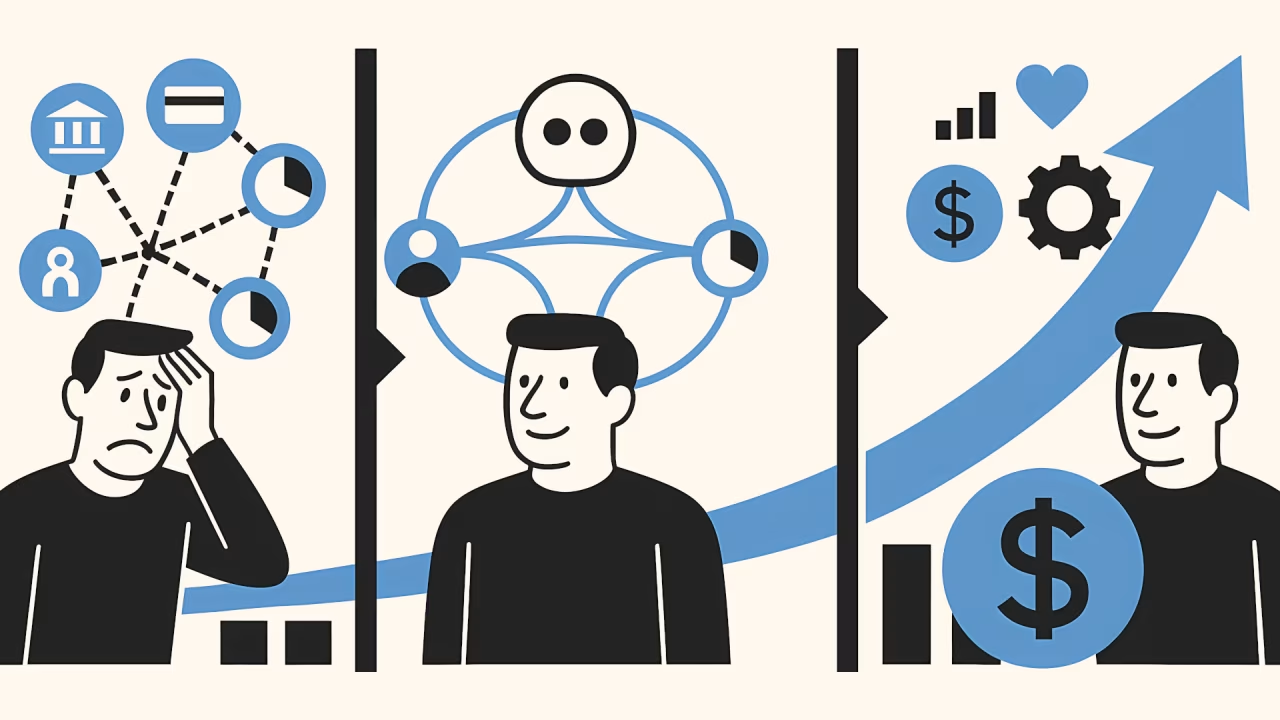

For decades, financial institutions have used data to, at best, fit most clients into predefined product molds - not for lack of intent necessarily, but because building solutions around the specific outcomes each is trying to achieve, at scale, had simply been out of reach. Optimizing that strategy further is no longer enough - we’ve hit diminishing returns. Instead, the next baseline for differentiation comes from self-driving financial data that unlocks a new tier of business value by acting autonomously on clients' behalf, in their best interests. It can even go as far as creating financial treatment unique to every person across all their financial providers, surpassing every expectation of advice and treatment. We are moving from data-powered systems to data with agency, creating a fundamental shift as revolutionary as the leap from the sextant to GPS navigation. No longer will financial providers merely inform or recommend within their product lines or provider silos. Instead, they will proactively orchestrate, decide, and execute for clients’ best interests across all financial products - and even across the industry as a whole. These outcomes will be tailored to each individual’s comprehensive contexts, goals, and constraints, with every action bolstering trust, loyalty, and revenue for those providers that embrace this new standard of personalization.

Learning from Other Industries

Twenty-five years ago, booking travel meant navigating a limited choice of products or rigid packages. Retail, too, was about making do with whatever the client could find. Today, such industries and many others have prioritized personalization, shouldering the effort of individual treatment for all so the customer doesn’t have to. They’ve securely opened their data and captured customer preferences, using it to scale personalization across all products for every customer. Platforms like Amazon, Netflix, and Spotify have shown that this personalization is a top profit driver, setting a standard consumers now universally expect, including for their financial matters. The finance industry has yet to experience this shift, but AI now makes it not only possible, but inevitable. This time however, the stakes and rewards are even higher. While retail personalization revolves around preferences in a sea of content and products, financial personalization must navigate deeply consequential decisions - often with long-term impact - making precision, trust, and context not just nice-to-haves, but mission-critical. Those who achieve it will win: A $1T+ shift in market share to these AI personalizing companies will result in the next 5 years, if not quicker.

Finance’s Current Gap

Open banking, scalable computing, and API connectivity were the genesis foundations for unlocking the first tier of value from financial data. Yet above this bedrock remains a significant gap: automated personal financial treatment today is shackled by siloed, narrow domain decision-making, lacking comprehensive context and autonomous action. One bank might alert the client about overspending or high credit utilization but misses broader contexts such as an upcoming salary deposit at another institution or a planned significant purchase needing investment deposits from yet a third provider. This fragmented, context-blind approach is a major limitation - particularly as consumers now manage relationships with six or more providers across an increasingly complex and crowded financial landscape. In other words, financial data still lacks the necessary self-driving agency, forcing clients to manually bridge the gaps - often poorly. As a result, many valuable opportunities go unrealized. For financial institutions, this means missed revenue, lower engagement, and lost cross-sell and up-sell opportunities. Instead, financial data should proactively and collaboratively advocate and automatically solve for client outcomes (not just selling products - a key nuance), which in-turn improves business results.

Agentic AI for Financial Personalization

Agentic AI bridges this gap by transforming financial data from passive and fragmented to self-driving and proactive. It enables secure, intelligent coordination across previously siloed data, making it easier to deliver the right product to the right client, at the right time. At the core are autonomous agents that interpret a client’s full financial landscape and providers’ complete product lineups. These agents plan and execute actions aligned to the client’s specific outcomes - not just within a single institution, but even across multiple providers and platforms - to autonomously create value for all parties involved.

Take loyalty schemes: those beloved airline miles and hotel points. In theory, they’re powerful retention tools. In practice, they’re under-leveraged because the systems behind them lack the self-driving agency to turn potential into outcomes. Consider Sarah, an avid cyclist dreaming of biking through the Alps, with points scattered across airlines, hotels, and credit cards. Individually, apps show balances; collectively, they fail to collaborate to turn that potential into a meaningful outcome. The result? Redemption rates remain low, point liability balances grow, and program engagement flatlines. More marketing emails won’t solve this - only smarter orchestration will. With agentic AI, however, Sarah’s preferences and intent are recognized. Her points are aggregated and optimized across providers, preferential pricing is negotiated, and the agents proactively assemble and book her ideal vacation - an outcome she wouldn’t have unlocked alone (at least, with ease).

Or consider dynamic cash flow management. Today, most institutions wait for a customer like Maya, a solopreneur, to request a credit facility or experience a shortfall. But by then, it’s often too late. She may already have missed a supplier payment or turned to a quick-fix competitor. Agentic AI prevents this entirely by detecting a projected cash crunch early and automatically arranging invoice financing in the background - keeping Maya’s business on track without her ever needing to ask or even know there was a problem in the first place.

Now consider commercial lending. Providers can spend weeks assessing creditworthiness and negotiating terms with clients like Jack, the CFO of a mid-sized manufacturer. That friction loses deals to competitors offering faster options. Instead, agentic systems see Jack’s short-term need, gather financials from his connected data, and engage two unaffiliated lenders. They negotiate joint terms, coordinate approvals, and deliver capital in hours - not weeks - improving both client satisfaction and institutional win rates while lowering origination costs.

In each case, agentic AI doesn't just improve client treatment - it unlocks major business value: higher product conversion, automated sales, deeper loyalty, and fewer operational bottlenecks. It transforms financial data into a self-driving growth engine.

This is the future of financial services - agentic personalization that pays and does so in spades for the institutions that embrace it.

Strategic Differentiation for Financial Providers

For financial institutions, agentic AI personalization is a radical business model upgrade. It enables them to break free from the constraints of commoditized products and expand meaningful, defensible value through intelligent, proactive engagement. Key differentiators include:

- Proactive Engagement: Anticipating and fulfilling customer needs before they’re even articulated, transforming moments of potential friction into value. For FIs, this means higher engagement rates, increased product uptake, and a stronger foothold in customers' financial lives, long before competitors without a self-driving data capability can even make a pitch.

- Hyper Personalization: Delivering dynamic, adaptive offerings uniquely tailored to individual life events, preferences, and behaviors. This deepens the trust relationship, positioning the FI not just as a product provider, but as an ongoing partner in the customer’s life - leading to greater loyalty and easier retention that can justify higher fees (...when has Netflix ever become cheaper with time?)

- Operational Efficiency: Automating decision-making and reducing manual processes across product lines, from onboarding and underwriting to servicing and support. This reduces the cost to serve and frees up human capacity to focus on higher-value tasks, while streamlining compliance workflows - improving both margin, regulatory compliance and speed to market.

- Ecosystem Orchestration: Integrating internal capabilities and external partners’ to offer clients end-to-end solutions. This enables FIs to move beyond siloed services - like deposits, payments, and credit - and into adjacent value-added offerings. For example: financial providers could easily partner with retailers to automatically bid in real time on providing warranty protection or purchase financing for clients’ larger transactions.

- Compounding Trust: By always showing up with the most relevant, beneficial solution - even if it’s not the most profitable in the short term - agentic AI helps FIs earn long-term trust equity. That trust compounds over time, reducing churn and opening doors to deeper financial relationships.

Ultimately, agentic AI helps FIs protect themselves from the ongoing commoditization of core financial products by differentiating on outcomes, not offerings. It unlocks new revenue streams, increases wallet share, and could even turn traditional cost centers (such as KYC) into revenue generators.

Balancing Agentic Personalization with Trust

Entrusting AI agents with financial decisions raises important considerations around alignment, transparency, and accountability. How do institutions ensure these agents consistently act in line with customers’ values, preferences, and risk tolerances? What safeguards ensure accountability, especially if an agent makes a misaligned decision?

Addressing these questions requires thoughtful design, transparent governance, and rigorous ethical standards. Financial institutions must essentially digitize the principles that have earned them client trust over significant periods, ensuring autonomy never compromises that foundation of trust. Furthermore, as AI and data regulations evolve rapidly, agentic AI can also serve as a critical ally, continuously adapting to new compliance expectations and embedding them into operational processes. Agentic AI in financial services is not only a catalyst for growth, but also an efficiency driver for staying ahead of evolving regulatory demands - embedding agentic compliance into operations by design. The resulting agentic future combines accuracy, empathy, and transparent intent to drive better outcomes for both institutions and the clients they serve.

Building this Future with BEAM

At BEAM, we believe your financial data should do more than inform - it should deliver outcomes and do so autonomously. We are building infrastructure for agentic financial personalization: self-driving data capabilities through embedded AI agents, and orchestration layers delivering the next generation of financial business growth. Our mission is to make this AI-driven personalization a day-to-day reality for millions of people, businesses and financial providers, without incumbents having to reinvent their core systems.

Institutions embracing this shift will not only deepen customer loyalty but unlock potent new revenue streams, redefining financial services for the next era. The future is already in motion - the institutions who see it are already building it with us. Join those shaping what’s next.