Owning Your Differentiation: AI Personalization in Financial Services

Financial services providers are at a critical inflection point. Clients expect the same deeply personalized, “know me” treatment from their financial providers as they get from digital leaders like Amazon or Netflix. 71% of consumers expect personalized interactions, and 76% are frustrated when this does not happen. In banking, 72% say personalization influences their choice of provider. Personalization is now the competitive baseline. Institutions that use AI to tailor experiences at an individual level will capture the next wave of loyalty, efficiency, and growth. Those that lag risk irrelevance. McKinsey estimates leaders in personalization generate significantly more revenue than peers and that top-tier personalization could unlock more than one trillion dollars across industries. Market share will shift firmly into the hands of AI-personalizing leaders in the coming years.

The Personalization Imperative in Finance

Personalization in finance is more than targeted offers or basic demographic segments. It uses automated, comprehensive insight and action to tailor every decision, product, and interaction to a segment of one in real time. It leverages and enriches all available data, including transaction patterns, financial goals, behavioral signals, and contextual life events, to proactively serve each client’s unique needs, automatically scaling financial firms’ revenue, loyalty, and efficiency. Products and advice find the right client at the right moment.

AI personalization gives your data agency. Systems orchestrate actions within defined bounds, such as moving surplus balances into savings automatically or optimizing rewards outcomes across providers, all aligned to clients’ individual objectives. This requires a break from one-size-fits-all product thinking. Servicing adapts to real-time behavior and needs, and delivers through the channel that works best, even outside the financial firm’s own. Done well, clients feel proactively understood and supported wherever they are. The payoff is stronger performance across all your business KPIs. Financial services firms that build AI personalization at scale see double-digit revenue growth and superior retention as competition heats up. In a trust-driven industry, consistently treating each client as unique is becoming a decisive source of advantage.

The Hard Way or the Easy Way

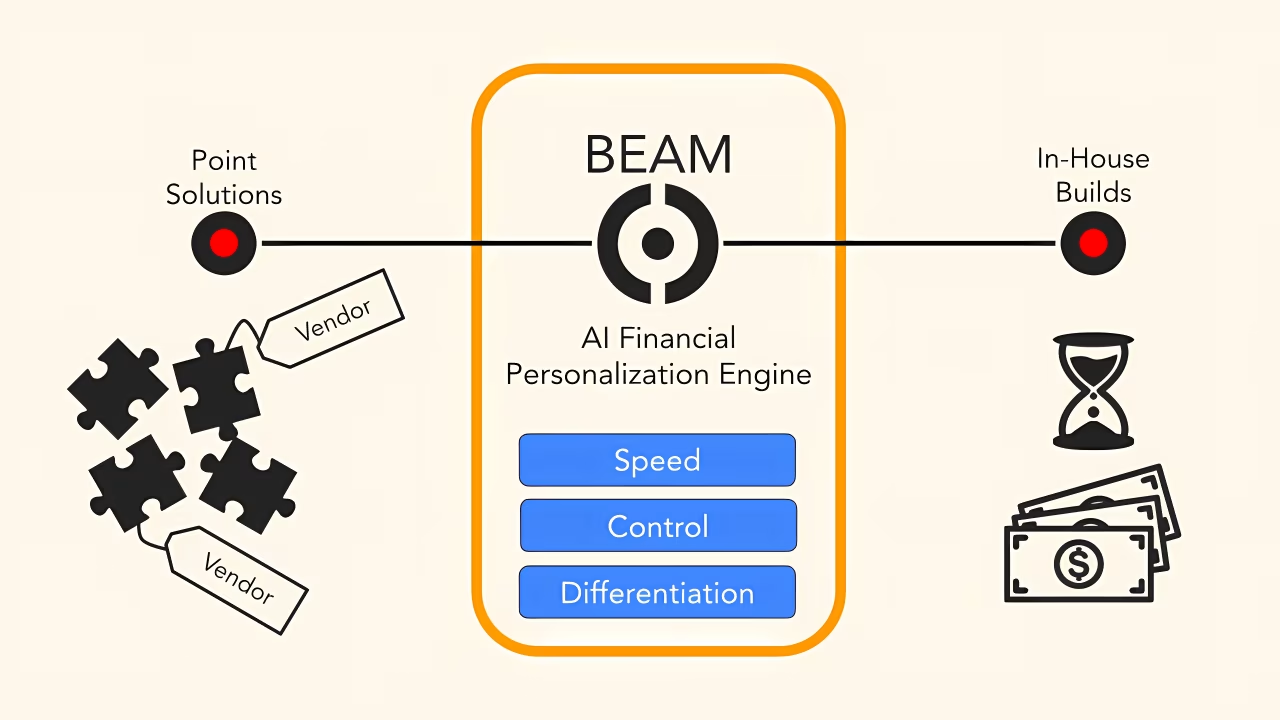

Vendor point solutions. Anyone can buy third-party tools for narrow and often generalized use cases, and so there is no lasting advantage, perhaps just limited first-adopter headway, and all funded through operating expense. Furthermore, these point solutions do not scale together across your firm, fail to deliver coherent and comprehensive AI personalization, and fall short of addressing your firm’s unique needs. They often limit how you can use your own data, may improve their models using your data that are sold to others, and can even charge you to use your own data! You also become dependent on someone else’s roadmap. Unwinding these integrations later is often much more costly than initial adoption.

In-house custom builds. A homegrown AI Financial Personalization Engine promises maximum control and differentiation. It also demands years, many tens of millions in investment, rare talent, and multiple cycles of trial and error to realize. Opportunity cost mounts while client expectations keep growing. The result is high execution risk, slow time to value, and accelerated client exodus to faster FinTechs getting this right, reducing your market share.

This dilemma leaves firms stuck between limited vendor point solutions and impractical DIY. There is a better path.

Your Own AI Financial Personalization Engine, Without the Excessive Wait, Risk, or Cost

BEAM provides your most cost-effective, rapid, and least risky way to Amazon-level, differentiated AI personalization for every client. It is a white-labeled AI Financial Personalization Engine that runs inside your infrastructure, alongside your existing technology and data. Your client data stays on your systems under your governance. The engine sits as a personalization layer in front of staff tools and client channels via APIs, observing and enriching interactions with real-time individualized context for each client.

You gain the benefits of a custom build at a fraction of the cost and time. BEAM arrives with a sophisticated AI, ML, and data foundation, so you do not start from zero. Deployed on it are your proprietary customizations that enable your business priorities through your own data. These become your competitive asset and can be treated as a capital investment. You avoid vendor lock-in and control your roadmap. Rather than two to three years, BEAM is live in under three months. You get speed, control, and differentiation at a fraction of internal build costs and timelines.

It is designed for messy reality. BEAM onboards incrementally by business use case and improves over time. You can prove value quickly on a few journeys, then scale to additional challenges, products, channels, and business units. As your AI personalization journey matures, the BEAM engine scales with it across millions of clients and incorporates new AI advances as they emerge. You get fast time to market and the long-term value of an owned, differentiating asset. It is a business model upgrade that grows revenue, efficiency, and loyalty while preserving your data and nurturing your AI edge.

How You Own Your Differentiation

Now you have your own AI Financial Personalization Engine, you continuously build and own the differentiation running on it through your customizations that reflect your strategy and market. Each are collections of AI agents that drive your value at scale across three categories:

- Revenue. Intelligent client-product matching pairs each client with the right product or service at the right time. Models enrich client context and market signals to surface timely opportunities, such as refinancing when rates move or a higher-yield option when balances grow.

- Loyalty. Lifecycle management nurtures financial well-being. Agents identify moments to assist or reward, prompt better habits after a bonus or challenge, and orchestrate points into meaningful outcomes that align to personal goals.

- Efficiency. Advisors, operations, and functions are augmented. Agents automate routine work, serve timely, context-relevant information for each job family, and provide real-time best recommendations for final human sign-off. This makes all your staff as productive as the top 20 percent. Redirect the time you get back to the highest-value tasks. Everyone wins.

These capabilities compound. Built on a shared AI personalization engine, each addition deepens the understanding of your every client. This rich client context is available across all your products, business units, and workflows in real time. Mobile, branch, contact center, and any embedded portal where you interface with your clients all draw from the same intelligence. The institution feels cohesive, available and client-centric because the AI core is learning and acting continually. This moat is yours. Competitors cannot buy it.

Embracing the Future on Your Terms

AI financial personalization is the move beyond commoditized products toward competing on client outcomes that accelerate your revenue, loyalty, and efficiency. Vendor point solutions cap your upside at best and create risk at worst. Full custom builds drain time and capital. Deploying your own AI financial personalization with BEAM gives you a state-of-the-art capability in months, with control and exclusivity over your data and AI. You get the head start of an AI Financial Personalization Engine built for scaling in the financial industry and the freedom to make it uniquely yours.

Institutions taking this path are deepening loyalty, protecting against FinTech threats, unlocking new revenue, and lowering costs. The future of finance is personal and it is already in motion. Join the organizations building it with BEAM and own your AI financial personalization differentiation now.